Home ≫ From Mark’s Desktop ≫ Question: How to achieve diversification with premium results?

Feb 28, 2022

Question: How to achieve diversification with premium results?

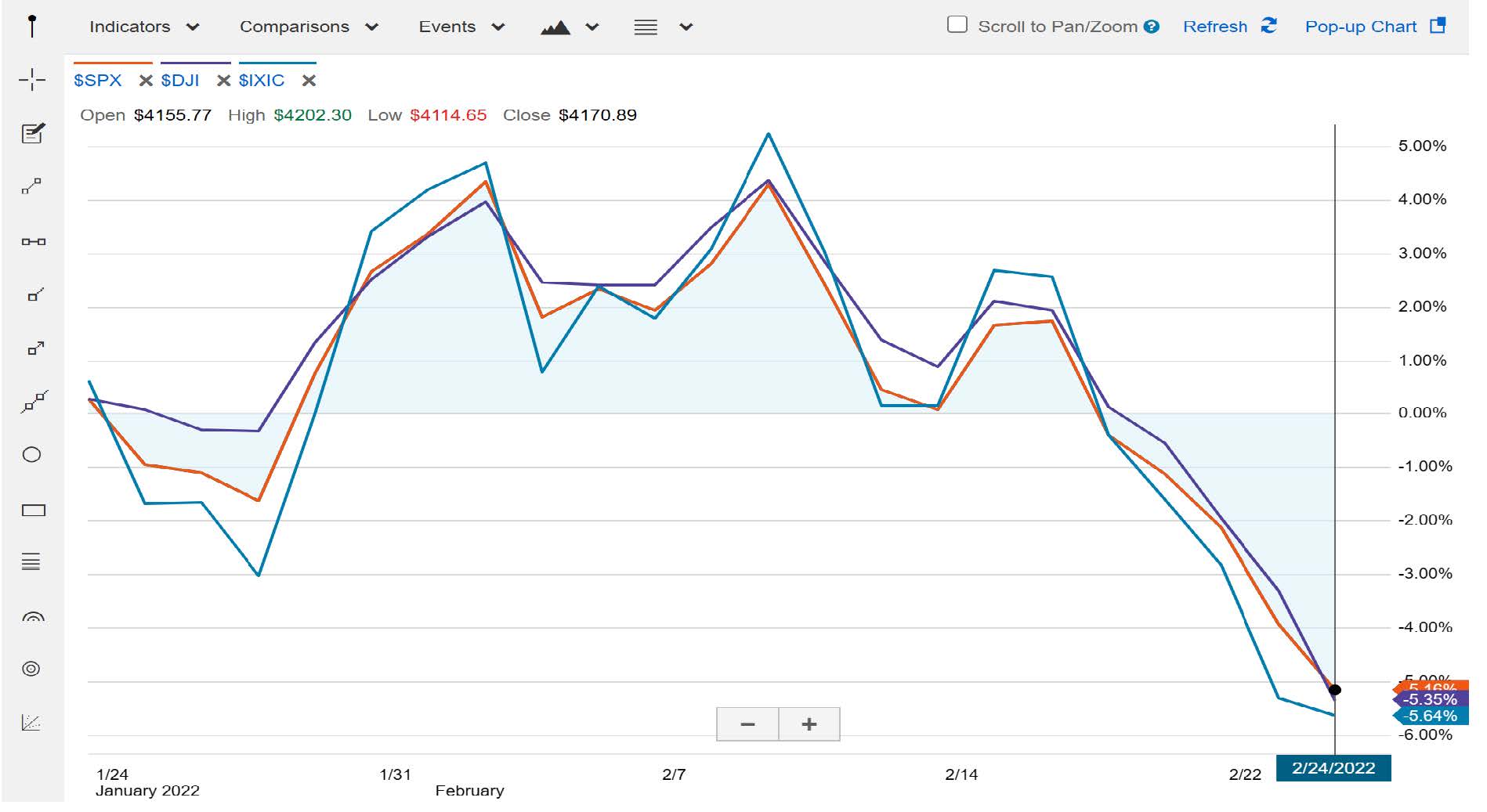

Financial planners to titans in the investing community preach diversification; but what exactly does this mean and how can Lions Mane Financial (LMF) help you accomplish this goal in your portfolio for the long-term? To put it bluntly, diversification is the act of spreading your investment dollars across multiple financial institutions and markets which allows you to balance risk among different types of investments. In doing so, your portfolio, and your emotions, will be able to weather the storms and the ups/downs of markets like depicted below. But it’s still important that you understand how your different investment categories work.

As William and I discuss the vision for our company moving forward, it always comes back to giving our investors comfort that a sustainable and reliable dividend payment for a portion of one’s portfolio is our mission. We utilize real estate as our investment vehicle.

So how does Lions Mane Financial operate? How do we use investor capital and turn it into dividends for the investor and revenue for our company? Simply put, we take investor money and invest in emerging real estate markets through short term, high value loans. Below, I’ll walk you through an example of an investor who invests $100,000 in our company and how LMF will turn that money into dividend payments for the investor, a loan for a borrower, and revenue for LMF.

First, let’s cover some assumptions:

- On average, we have paid our investors 8-10% over the past seven years for the use of their money. In this example, let’s assume we are paying this particular investor an 8.5% annual dividend. By the way, this type of investment allows us to pay dividends every month. We don’t ask our investors to wait until the end of a quarter to see their results.

- At any time, LMF funds 30-60 loans. These loans are charged at a rate of 10.5-12% with points and fees. In this example, our borrower’s $100,000 loan is funded at an interest rate of 10.5% and 2 points.

- Majority of our loan terms are 6-8 months, giving us ample cash to pay dividend holders, support company overhead, and reinvest quickly.

Now the math for this 6-month, $100K loan:

- Investor: $8,500/year in dividend payments ($708.33/month)

- Borrower: $10,500/year in loan payments ($875.00/month) + 2 points ($2,000)

- Upon payoff, the borrower will have paid a total of $7,250 in interest and points– an annual return investment for LMF of 14.5%. During the 6-month loan, the investor was paid dividends totaling $4,250 and LMF receives $3,250. LMF uses this money to pay its expenses, such as salaries, marketing, underwriting, etc., and then reloans this $100,000 to the marketplace as quickly as possible.

One of the other benefits LMF and our investors enjoy is the fact that our modeling and lending structure is dynamic. As housing demands change or interest rates adjust, we can do so as well.

To sum it up, diversification is an important tool in your financial portfolio, and Lions Mane Financial aims to help investors mitigate risk, all while delivering reliable dividends.

We hope you join our team!

Mark P. Andreotta

President

Lions Mane Financial aka Hard Money2Go